- Question: Required information

[The following information applies to the questions displayed below.]

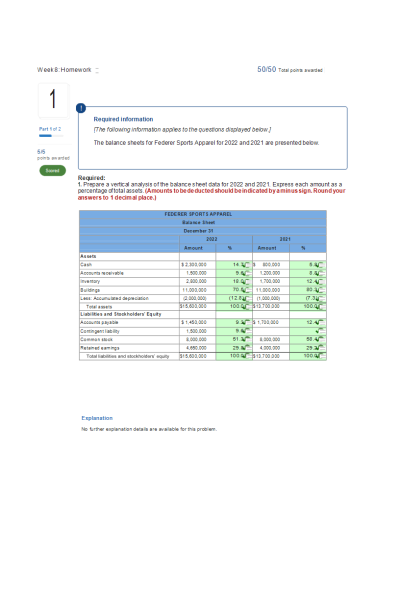

The balance sheets for Federer Sports Apparel for 2022 and 2021 are presented below.

Required:

Prepare a vertical analysis of the balance sheet data for 2022 and 2021. Express each amount as a percentage of total assets. (Amounts to be deducted should be indicated by a minus sign. Round your answers to 1 decimal place.)

- Question: Required information

[The following information applies to the questions displayed below.]

The balance sheets for Federer Sports Apparel for 2022 and 2021 are presented below.

Prepare a horizontal analysis for 2022 using 2021 as the base year. (Note: If the percentage increase or

decrease cannot be calculated, then leave the cell blank. Decreases should be indicated by a minus sign. Round your percentage answers to 1 decimal place.)

- Question: The 2021 income statement of Adrian Express reports sales of $18,957,000, cost of goods sold of $11,971,500, and net income of $1,690,000. Balance sheet information is provided in the following table.

Required:

- Calculate the four risk ratios listed above for Adrian Express in 2021. (Use 365 days in a year. Round your answers to 1 decimal place.)

- Do you think the company is more risky or less risky than the industry average?

4. Question: The 2021 income statement of Adrian Express reports sales of $19,710,000, cost of goods sold of $12,350,000, and net income of $1,780,000. Balance sheet information is provided in the following table.

Required:

- Calculate the five profitability ratios listed above for Adrian Express. (Round your answers to 1 decimal place.)

- Do you think the company is more profitable or less profitable than the industry average?

5. Question: The following condensed information is reported by Sporting Collectibles.

Required:

- Calculate the following profitability ratios for 2021: (Round your answers to 1 decimal place.)

- Determine the amount of dividends paid to shareholders in 2021.

6. Question: The following income statement and balance sheets for Virtual Gaming Systems are provided.

Required:

Assuming that all sales were on account, calculate the following risk ratios for 2021. (Use 365 days a year. Round your final answers to 1 decimal place.)

| Instituition / Term | |

| Term | Summer 2021 |

| Institution | ACCT 212 Financial Accounting |

| Contributor | Jessica Brown |