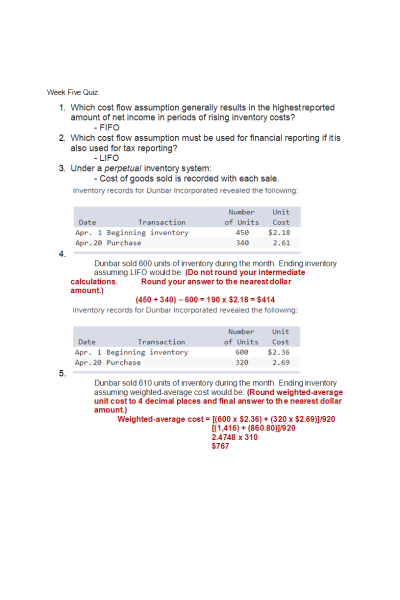

- Question: Which cost flow assumption generally results in the highest reported amount of net income in periods of rising inventory costs?

- Question: Which cost flow assumption must be used for financial reporting if it is also used for tax reporting?

- Question: Under a perpetual inventory system:

- Question: Dunbar sold 600 units of inventory during the month. Ending inventory assuming LIFO would be: (Do not round your intermediate

calculations. Round your answer to the nearest dollar amount.)

(450 + 340) – 600 = 190 x $2.18 = $414

- Question: Dunbar sold 610 units of inventory during the month. Ending inventory assuming weighted-average cost would be: (Round weighted-average unit cost to 4 decimal places and final answer to the nearest dollar amount.)

Weighted-average cost = [(600 x $2.36) + (320 x $2.69)]/920

[(1,416) + (860.80)]/920

2.4748 x 310

$767

- Question: What is the cost of goods sold for Julia & Company assuming it uses LIFO? (Do not round your intermediate calculations. Round your answer to the nearest dollar amount.)

- Question: Marvin sold 1,910 units of inventory during the month. Cost of goods sold assuming FIFO would be: (Do not round your intermediate calculations. Round your answer to the nearest dollar amount.)

8. Question: A company's sales equal $60,000 and cost of goods sold equals $20,000. Its beginning inventory was $1,600 and its ending inventory is $2,400. The company's inventory turnover ratio equals:

9. Question: Anthony's average days in inventory is: (Round to the nearest whole day.)

Net Sale/Average Accounts Receivable = Receivable Turn Over Ratio

($138,000/$50,000) = 2.76

Average collection period = 365 days/Receivable Turn Over Ratio

(365/2.76) = 132.2 days

10. Question: Anthony's gross profit ratio is:

| Instituition / Term | |

| Term | Summer 2021 |

| Institution | ACCT 212 Financial Accounting |

| Contributor | Jessica Brown |