ACCT 212 Week 4 Homework:

1. Question: Select the appropriate provisions of the Sarbanes-Oxley Act (SOX) for each of the following descriptions.

- Executives must personally certify the company’s financial statements.

- Audit firm cannot provide a variety of other services to its client, such as investment advising.

- PCAOB establishes standards related to the preparation of audited financial reports.

- Lead audit partners are required to change every five years.

- Management must document the effectiveness of procedures that could affect financial reporting.

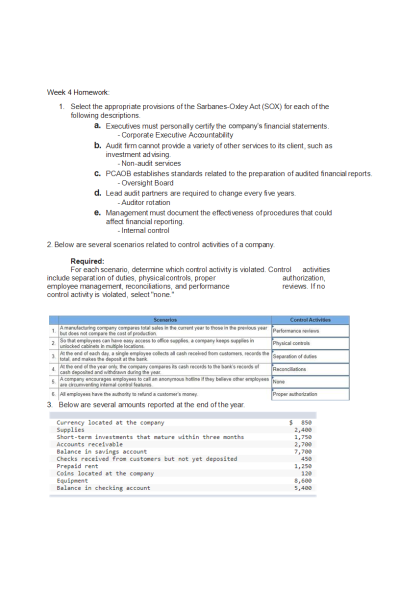

2. Question: Below are several scenarios related to control activities of a company.

Required:

For each scenario, determine which control activity is violated. Control activities include separation of duties, physical controls, proper authorization, employee management, reconciliations, and performance reviews. If no control activity is violated, select "none."

3. Question: Below are several amounts reported at the end of the year.

- Currency located at the company $850

- Short-term investments that mature within three months $1,750

- Balance in savings account $7,700

- Checks received from customers but not yet deposited $450

- Coins located at the company $120

- Balance in checking account $5,400

4. Question: Mercy Hospital has the following balances on December 31, 2021, before any adjustment:

Accounts Receivable = $63,000; Allowance for Uncollectible Accounts = $1,500 (credit). Mercy estimates uncollectible accounts based on an aging of accounts receivable as shown below.

Required:

a. Estimate the amount of uncollectible receivables.

b. Record the adjusting entry for uncollectible accounts on December 31, 2021. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.)

Calculate net accounts receivable.

5. Question: Below are amounts (in millions) from three companies' annual reports.

Required:

Calculate the receivables turnover ratio and the average collection period for WalCo, TarMart and CostGet. (Do not round intermediate calculations. Enter your answers in millions. Round your "Average accounts receivable" and "Receivables turnover ratio" answers to one decimal place.)

- Which company appears most efficient in collecting cash from sales?

6. Question:

Required:

a. Record the adjusting entry for uncollectible accounts using the percentage-of-receivables method. Suzuki estimates 11% of receivables will not be collected. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Bad Debt Expense = (Accounts Receivable, December 31, 2021 x % receivables will not be collected) – Allowance for Uncollectable Accounts, December 31, 2021 (Credit)

Bed Debt Expense = ($35,000 x 11%) - $1,200 = $2,650 Bad Debt Expense (Debit) $2,650

Allowance for Uncollectible Accounts (Credit) $2,650

7. Question:

Record the adjusting entry for uncollectible accounts using the percentage-of-credit-sales method. Suzuki estimates 3% of credit sales will not be collected. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.)

8. Question:

c. Calculate the effect on net income (before taxes) and total assets in 2021 for each method. Suzuki estimates 11% of receivables and 3% of credit sales respectively will not be collected.

ACCT 212 Week 4 Homework Practice:

1. Question: Select the appropriate control activities for each of the following definitions.

- The company should maintain security over assets and accounting records.

- Management should periodically determine whether the amounts of physical assets of the company match the accounting records.

- The company should provide employees with appropriate guidance to ensure they have the knowledge necessary to carry out their job duties.

- The actual performance of individuals or processes should be checked against their expected performance.

- Authorizing transactions, recording transactions, and maintaining control of the related assets should be separated among employees.

- To prevent improper use of the company’s resources, only certain employees are allowed to carry out certain business activities.

2. Question: Below are several statements about the Sarbanes-Oxley Act (SOX).

Required:

Select whether the answer to each of the statements is true or false.

3. Question: Below are several amounts reported at the end of the year.

Required:

Calculate the amount of cash to report in the balance sheet.

4. Question: Mercy Hospital has the following balances on December 31, 2021, before any adjustment: …….

Accounts Receivable = $70,000; Allowance for Uncollectible Accounts = $1,400 (credit). Mercy estimates uncollectible accounts based on an aging of accounts receivable as shown below.

Required:

- Estimate the amount of uncollectible receivables.

- Record the adjusting entry for uncollectible accounts on December 31, 2021. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.)

- Calculate net accounts receivable.

5. Question: Below are amounts (in millions) from three companies' annual reports.

Required:

a. Calculate the receivables turnover ratio and the average collection period for WalCo, TarMart and CostGet. (Do not round intermediate calculations. Enter your answers in millions. Round your "Average accounts receivable" and "Receivables turnover ratio" answers to one decimal place.)

b. Which company appears most efficient in collecting cash from sales?

6. Question:

Required:

a. Record the adjusting entry for uncollectible accounts using the percentage-of-receivables method. Suzuki estimates 12% of receivables will not be collected. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.)

7. Question:

a. Record the adjusting entry for uncollectible accounts using the percentage-of-credit- sales method. Suzuki estimates 3% of credit sales will not be collected. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.)

8. Question:

c. Calculate the effect on net income (before taxes) and total assets in 2021 for each method. Suzuki estimates 12% of receivables and 3% of credit sales respectively will not be collected.

| Instituition / Term | |

| Term | Summer 2021 |

| Institution | ACCT 212 Financial Accounting |

| Contributor | Jessica Brown |