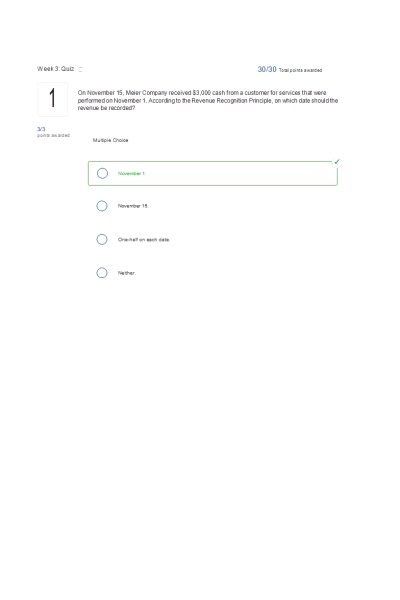

- Question: On November 15, Meier Company received $3,000 cash from a customer for services that were performed on November 1. According to the Revenue Recognition Principle, on which date should the revenue be recorded?

- Question: Under accrual-basis accounting, companies typically report expenses:

- Question: On March 4, Tonkawa Law asks Green Lawn Services for basic lawn maintenance totaling $200. Green Lawn provides maintenance on March 8, and Tonkawa pays for the lawn maintenance on March 12. Under accrual-basis accounting, on which date should Tonkawa record lawn maintenance expense?

- Question: The following table contains financial information for Trumpeter Inc. before closing entries:

Cash $13,200

Supplies 4,700

Prepaid Rent 3,000

Salaries Expense 6,200

Equipment 66,800

Service Revenue 29,200

Miscellaneous Expenses 20,400

Dividends 3,700

Accounts Payable 4,100

Common Stock 67,000

Retained Earnings 17,700

What is Trumpeter's net income?

- Question: A company performs $2,100 of services during the month and bills customers. The customers are expected to pay next month. Record the customer billing using (a) accrual-basis accounting and (b) cash-basis accounting. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

- Question: Suppose a company rents office space for one year, paying $21,000 ($1,750/month) in advance on September 1. Record the adjusting entry on December 31. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

- Question: A gym offers one-year memberships for $99 and requires customers to pay the full amount of cash at the beginning of the membership period. For the gym, this is an example of a(n:

- Question: Receiving a utility bill for costs in the current period but delaying payment until the following period is an example of a(n):

- Question: Which of the following would not typically be used as an adjusting entry?

- Question: The closing entry for expenses includes:

| Instituition / Term | |

| Term | Summer 2021 |

| Institution | ACCT 212 Financial Accounting |

| Contributor | Jessica Brown |