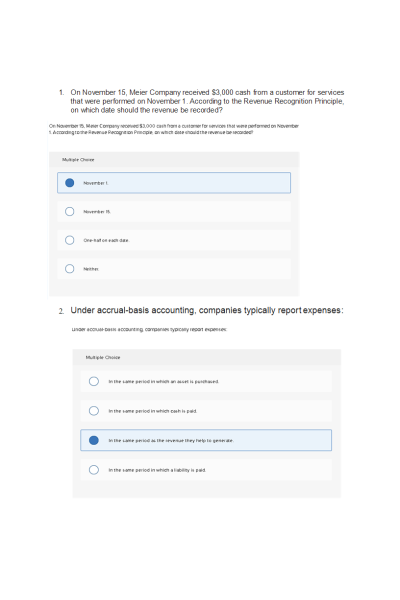

- Question: On November 15, Meier Company received $3,000 cash from a customer for services that were performed on November 1. According to the Revenue Recognition Principle, on which date should the revenue be recorded?

- Question: Under accrual-basis accounting, companies typically report expenses:

- Question: On March 4, Tonkawa Law asks Green Lawn Services for basic lawn maintenance totaling $200. Green Lawn provides maintenance on March 8, and Tonkawa pays for the lawn maintenance on March 12. Under accrual-basis accounting, on which date should Tonkawa record lawn maintenance expense?

- Question: The following table contains financial information for Trumpeter Inc. before closing entries:

|

|

Cash | $13,600 |

Supplies | 6,000 |

Prepaid Rent | 3,200 |

Salaries Expense | 6,400 |

Equipment | 65,300 |

Service Revenue | 28,200 |

Miscellaneous Expenses 21,200 | |

Dividends | 3,800 |

Accounts Payable | 3,500 |

Common Stock | 66,300 |

Retained Earnings | 21,500 |

What is Trumpeter's net income?

- Question: A company performs $2,700 of services during the month and bills customers. The customers are expected to pay next month.

Record the customer billing using (a) accrual-basis accounting and (b) cash-basis accounting. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

- Question: Suppose a company rents office space for one year, paying $24,000 ($2,000/month) in advance on September 1.

- Question: A gym offers one-year memberships for $99 and requires customers to pay the full amount of cash at the beginning of the membership period. For the gym, this is an example of a(n):

- Question: Receiving a utility bill for costs in the current period but delaying payment until the following period is an example of a(n):

- Question: Which of the following would not typically be used as an adjusting entry?

- Question: The closing entry for expenses includes:

| Instituition / Term | |

| Term | Summer 2021 |

| Institution | ACCT 212 Financial Accounting |

| Contributor | Jessica Brown |