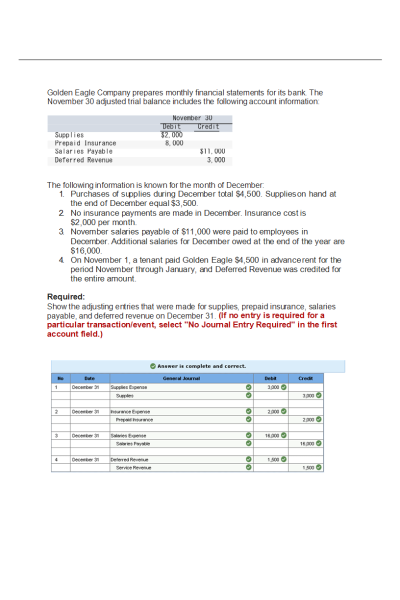

1. Question: Golden Eagle Company prepares monthly financial statements for its bank. The November 30 adjusted trial balance includes the following account information: …….. The following information is known for the month of December:

- Purchases of supplies during December total $4,500. Supplies on hand at the end of December equal $3,500.

- No insurance payments are made in December. Insurance cost is

$2,000 per month.

- November salaries payable of $11,000 were paid to employees in December. Additional salaries for December owed at the end of the year are $16,000.

- On November 1, a tenant paid Golden Eagle $4,500 in advance rent for the period November through January, and Deferred Revenue was credited for the entire amount.

Required:

Show the adjusting entries that were made for supplies, prepaid insurance, salaries payable, and deferred revenue on December 31. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.)

2. Question: Consider the following transactions for Huskies Insurance Company:

- Equipment costing $39,600 is purchased at the beginning of the year for cash. Depreciation on the equipment is $6,600 per year.

- On June 30, the company lends its chief financial officer

$46,000; principal and interest at 6% are due in one year.

- On October 1, the company receives $14,400 from a customer for a one-year property insurance policy. Deferred Revenue is credited.

Required:

For each item, record the necessary adjusting entry for Huskies Insurance at its year-end of December 31. No adjusting entries were made during the year. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Do not round intermediate calculations.)

3. Question: Consider the following situations for Shocker:

- On November 28, 2021, Shocker receives a $3,300 payment from a customer for services to be rendered evenly over the next three months. Deferred Revenue is credited.

- On December 1, 2021, the company pays a local radio station

$2,460 for 30 radio ads that were to be aired, 10 per month, throughout December, January, and February. Prepaid Advertising is debited.

- Employee salaries for the month of December totaling $7,200 will be paid on January 7, 2022.

- On August 31, 2021, Shocker borrows $62,000 from a local bank. A note is signed with principal and 6% interest to be paid on August 31, 2022.

Required:

Record the necessary adjusting entries for Shocker at December 31, 2021. No adjusting entries were made during the year. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Do not round intermediate calculations.)

4. Question: Boilermaker Unlimited specializes in building new homes and remodeling existing homes. Remodeling projects include adding game rooms, changing kitchen cabinets and countertops, and updating bathrooms. Below is the year- end adjusted trial balance of Boilermaker Unlimited.

Required:

- Prepare an income statement for the year ended December 31, 2021.

- Prepare the statement of stockholders’ equity for the year ended December 31, 2021, note that during the year the company issued additional common stock for $29,000. This amount is included in the amount for Common Stock in the adjusted trial balance.

- Prepare the classified balance sheet for the year ended December 31, 2021.

| Instituition / Term | |

| Term | Summer 2021 |

| Institution | ACCT 212 Financial Accounting |

| Contributor | Jessica Brown |